By Maria Mascola and William Paige

Since 2018, The Waterfront Project has been dedicated to helping New Jersey residents navigate the complexities of the foreclosure process. We now have a full team of HUD-Certified housing counselors who offer support and education to client’s while reminding them they don’t have to go through this alone.

While the foreclosure process in New Jersey can be extensive, we would like to share with you the basic timeline of the New Jersey foreclosure process.

When the borrower misses just one loan payment, they are considered delinquent, if the borrower continues to miss payments, the account will eventually go into default.

Just 15 days after the mortgage payment is missed, late charges begin to accrue. At this point the loan servicer will send written correspondence to the borrower attempting to collect the payment. Then, 30-60 days after the missed payment the lender will send the borrower a pre-foreclosure notice. This gives the borrower time to seek out assistance. Between 45-60 days after the missed payment, the loan servicer will send a demand or breach letter pointing out the terms of the mortgage that have been violated.

It is important not to overlook any communication received by the lender. Early intervention may make a big difference in achieving the retention of your property.

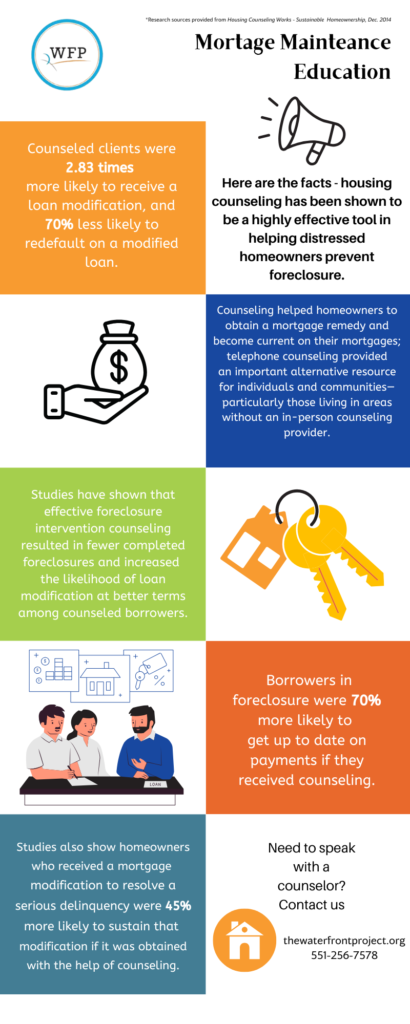

As overwhelming at this sounds, we are here to help. It is important not to wait. The Waterfront Project is committed to help you navigate this process and assist you in identifying any possible solution there may be. Education and counseling are vital to removing the stigma around foreclosure and we look forward to assisting you.

Read more to learn why housing counseling is important!

Contact us today for more information and assistance.