By Willaim “Bill” Paige

When a veteran purchases a home using a VA-guaranteed home loan, the loan is typically transferred to a mortgage servicer after closing. This servicer manages the loan, including receiving monthly payments and providing assistance if issues arise.

If the veteran experiences difficulty making payments and the loan becomes delinquent, the VA offers supplemental servicing support to help resolve the default. While the mortgage servicer is the first point of contact and has the primary responsibility to help the borrower avoid foreclosure, the VA’s Loan Guaranty program also employs Loan Technicians across eight Regional Loan Centers and two special servicing centers. These VA staff can work directly with the servicer and veteran to explore every available option to retain the home.

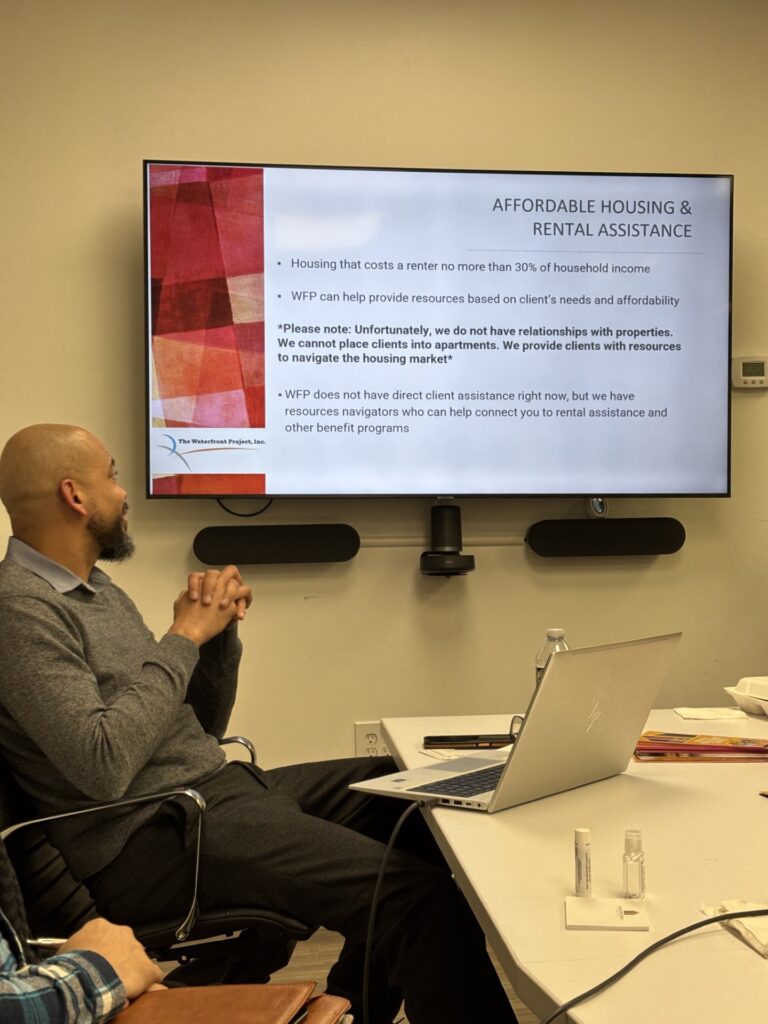

At The Waterfront Project, our HUD-Certified Foreclosure Prevention Specialists are trained to help veterans understand their options and work with their mortgage servicers under the VA’s retention guidelines to find solutions that protect homeownership.

If a veteran receives a foreclosure summons, there are additional supports available in New Jersey:

· The NJ Housing and Mortgage Finance Agency (NJHMFA) operates a Foreclosure Mediation Program. This allows homeowners to meet with both their servicer and a trained mediator to develop a plan to remain in the home.

· NJHMFA also offers the Emergency Rescue Mortgage Assistance (ERMA) program. This resource provides financial support to homeowners who have suffered income loss or increased expenses due to COVID-19 and are struggling to stay current on their mortgage.

Our housing counselors can guide you through the application process for these programs and accompany you to mediation sessions until your case is resolved. If you are a veteran in need, don’t wait—reach out to The Waterfront Project today.

Additional resources for veterans can be found here.