Written By the WFP Foreclosure Team

A government shutdown may start in Congress, but its real impact is felt at the closing table—and in the lives of everyday Americans. Homebuyers face stalled loans and canceled closings, while current homeowners deal with delayed services and added uncertainty. Although programs like Fannie Mae and Freddie Mac continue to operate, many families relying on FHA, VA, or USDA loans are left waiting, worrying, and wondering what comes next. The National Flood Insurance Program (NFIP) may be unable to issue new policies, preventing some buyers from finalizing their purchases—especially in high-risk flood areas. Even basic steps like verifying income through the IRS or Social Security Administration can be delayed, creating frustration and financial uncertainty for buyers and homeowners alike.

Mortgage payments are on the rise nationwide, averaging between $2,127.00 and $2,329.00 in 2025, and even higher in states like New Jersey. The average monthly mortgage payment in New Jersey varies by source, but recent figures show it can range from approximately $2,797.00 to $3,657.00. As you can imagine, any delay or disruption can hit families hard. In short, the longer a government shutdown lasts, the more strain it puts on families trying to buy, refinance, or simply stay secure in their homes. Homeownership has always been a cornerstone of stability and opportunity in this country. As we navigate these uncertain times, it’s important for homeowners and buyers to stay informed, stay patient, and stay in communication with their lenders. Political disagreements may be temporary—but for families working to build a stable home, every delay has a lasting impact.

The government shutdown can affect renters by causing a delay in federal housing assistance payments, putting some tenants at risk of eviction if the shutdown is prolonged, especially those in HUD assisted housing. It can also affect renters who are federal employees not receiving their paychecks making it difficult to pay rent. Non-federally funded rental programs are generally unaffected but state and local eviction processes still apply. Other federal benefits like SNAP and TANF could impact a family’s ability to pay rent.

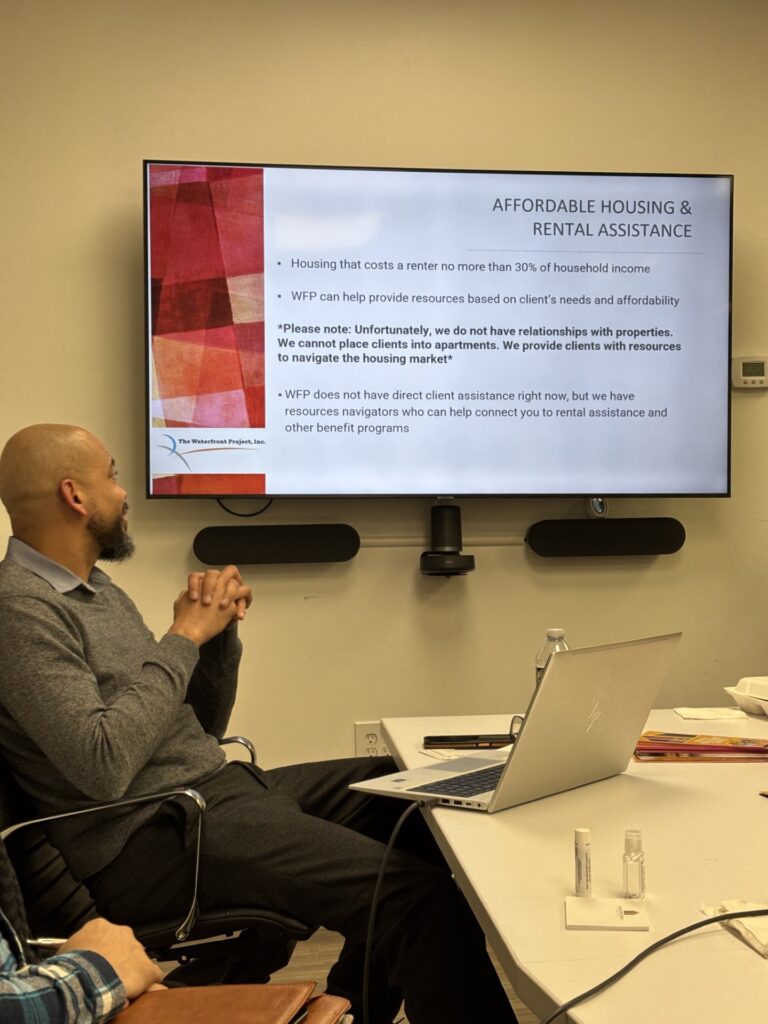

Federal employees: Federal employees who are furloughed or not getting paid may struggle to pay their rent, potentially leading to late payments or evictions. Here is some information that might help during the government shutdown.

National Association of REALTORS®

U.S. Department of Housing and urban Development

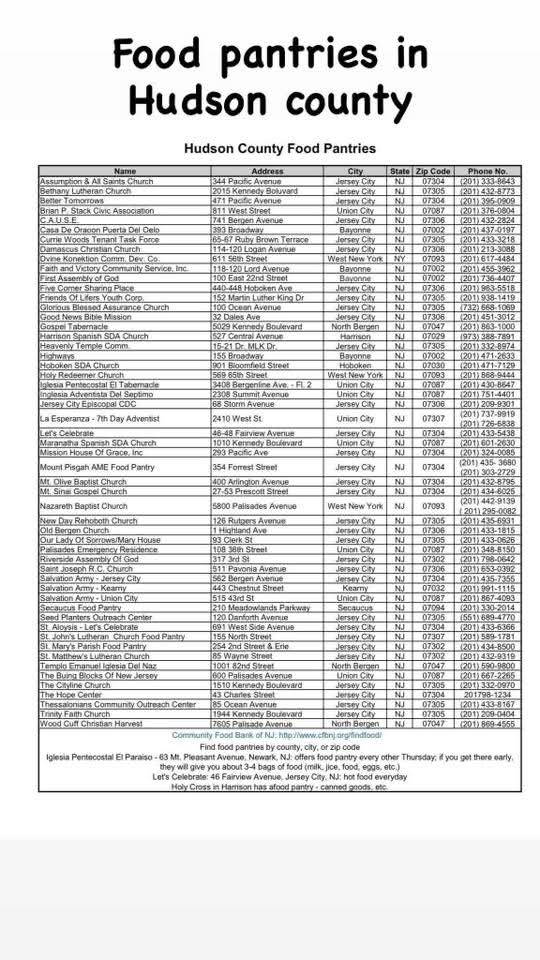

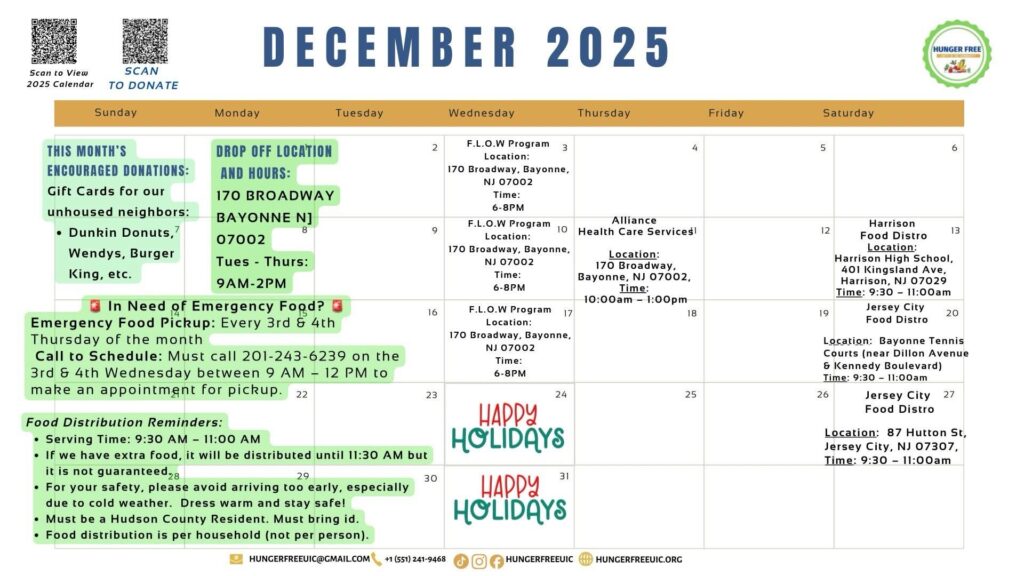

Here are some Local Pantries in Hudson County and food distribution calendars for Bayonne, New Jersey.

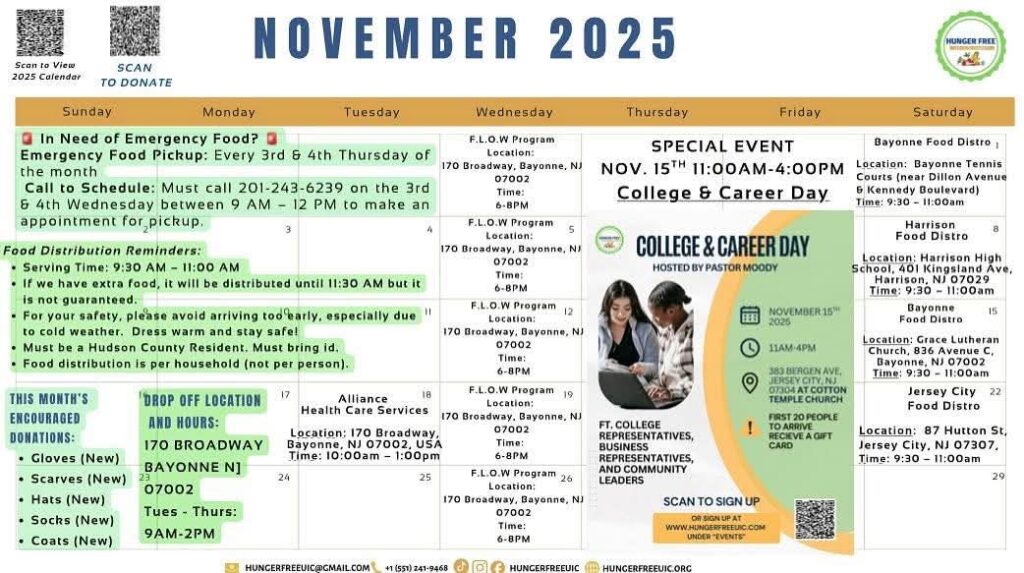

Calendar provided by Hunger Free in Bayonne, NJ.