Written By William Paige, Certified Foreclosure Specialist at The Waterfront Project

Before purchasing a home with Homeowners Association (HOA) dues, it is critical to understand both the benefits and the potential financial risks. HOAs are common in condominiums, co-ops, townhouses, and planned communities, and membership is mandatory when you buy a property governed by an HOA.

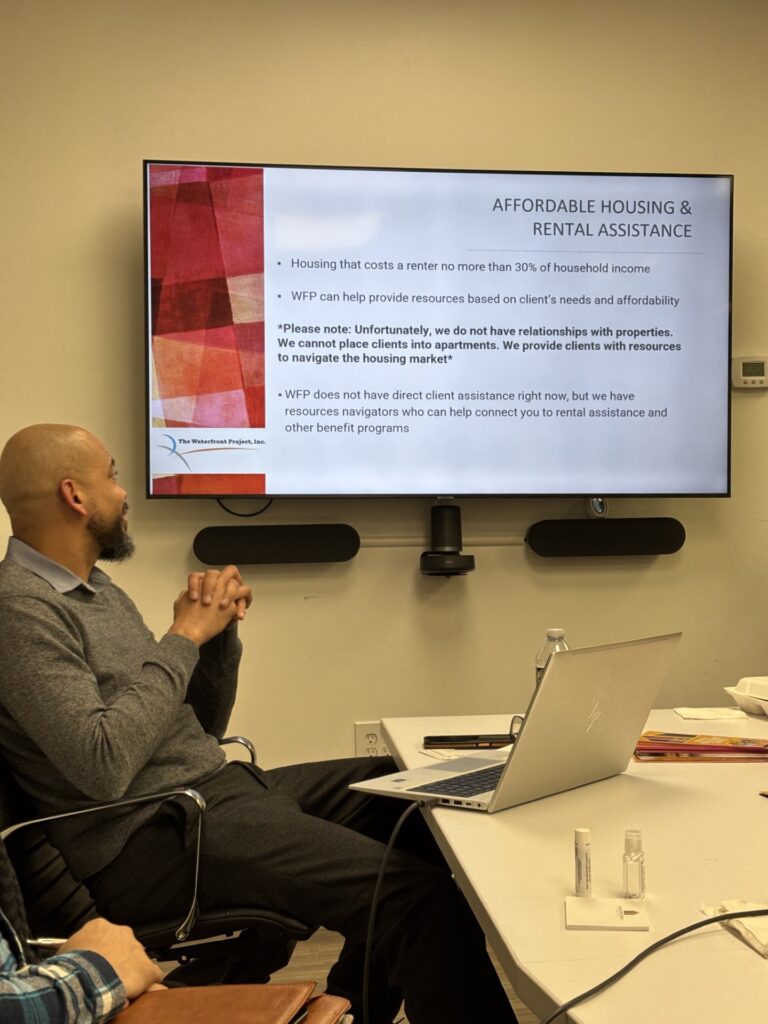

As a HUD Certified Housing Counseling Agency, we frequently work with first-time homebuyers, current homeowners, and seniors who are affected by HOA fees. The information below will help you make an informed decision before purchasing—or continuing to live—in an HOA community.

What Is a Homeowners Association?

A Homeowners Association (HOA) is an organization that governs a residential community. When you purchase a property in an HOA-governed development, you automatically become a member and are required to:

· Pay monthly or annual HOA dues

· Follow the community’s rules and regulations (often called CC&Rs—Covenants, Conditions, and Restrictions)

HOA dues are separate from property taxes and are used to fund the association’s operating budget, maintenance, insurance, and shared amenities. HOAs are typically managed by a board of directors elected by homeowners, who make decisions about budgets, repairs, rules enforcement, and long-term planning.

Types of HOA Communities and How Fees Differ

Condominiums and Co-ops

In condominiums and cooperative buildings, HOA or association fees are usually higher because they often cover:

· Exterior and structural maintenance (roof, siding, windows)

· Common areas (hallways, elevators, lobbies)

· Amenities (gyms, pools, security)

· Trash removal

· Building insurance

· Sometimes water, sewer, or heat

In these properties, homeowners generally own only the interior of their unit, from the drywall inward.

According to Zillow (2025), average monthly HOA dues in New Jersey range from $400 to $700, with luxury buildings exceeding $1,000 per month.

Planned Unit Developments (PUDs)

Planned Unit Developments (PUDs) may include townhouses or single-family homes and operate under specialized zoning rules.

In most PUDs:

· You own your home, the land, and all attached structures

· HOA fees are typically lower

· Fees usually cover shared amenities such as parks, pools, playgrounds, sidewalks, or common landscaping

Homeowners are fully responsible for:

· Roof and structural repairs

· HVAC systems

· Interior and exterior maintenance

· Yard upkeep (unless otherwise stated)

While PUDs may offer more independence, they can still have strict rules regarding property appearance, parking, landscaping, trash disposal, and use of common areas.

HOA Rules and Restrictions

HOAs enforce rules that may include:

· Noise restrictions

· Limits on renting or subleasing

· Parking regulations and vehicle limits

· Lawn maintenance and landscaping requirements

· Exterior paint colors and renovations

· Pool and recreational area usage

· Trash and bulk item disposal

All rules are outlined in the HOA’s governing documents and are legally enforceable.

Special Assessments: A Major Financial Risk

In addition to regular dues, HOAs may impose special assessments when reserve funds are insufficient for major or unexpected expenses, such as:

· Roof replacement

· Structural repairs

· Storm or emergency damage

These one-time fees can cost homeowners thousands of dollars and are often unexpected. Reviewing an HOA’s financial statements and reserve funding is essential before purchasing.

Legal Consequences of Not Paying HOA Fees

HOA dues are a mandatory contractual obligation. Failure to pay can result in serious legal consequences, including:

· Late fees and interest

· Suspension of amenities

· Lawsuits to collect the debt

· Liens placed on your property

· Difficulty selling or refinancing

· Foreclosure to recover unpaid dues

· Wage garnishment or bank levies in some cases

In New Jersey, HOAs have strong enforcement powers to collect unpaid fees.

Impact on First-Time Homebuyers

HOA dues significantly affect affordability:

· Lenders include HOA fees in your debt-to-income (DTI) ratio

· Higher fees can reduce your borrowing power

· Monthly housing costs increase beyond mortgage, taxes, and insurance

First-time buyers should carefully review:

· CC&Rs and bylaws

· HOA meeting minutes

· Financial statements and reserve funds

· Management company performance

· What utilities or services are included in the dues

Seniors Living in HOA Communities

For many seniors, HOA fees become increasingly difficult over time. While HOAs may offer convenience and maintenance-free living, rising dues and special assessments can create serious financial strain.

Many seniors live on fixed incomes such as Social Security or pensions, which do not increase at the same pace as HOA costs. This can result in:

· Financial hardship

· Paying for amenities no longer used

· Being “house-rich but cash-poor”

· Feeling trapped in an unaffordable home

Seniors may qualify for a reverse mortgage in an HOA community, but they must remain current on:

· HOA dues

· Property taxes

· Homeowners insurance

Failure to pay these obligations—even with a reverse mortgage—can still lead to foreclosure. Additionally, the HOA community itself must meet eligibility requirements.

Know Before You Buy—or Stay

New Jersey law, including the Planned Real Estate Development Full Disclosure Act (PREDFDA), requires HOAs to plan for future repairs, but poor management can still place homeowners at risk.

You cannot refuse to join an HOA when purchasing a property in an HOA-governed community. Understanding the rules, costs, and long-term financial impact is essential.

Get Trusted, HUD-Certified Guidance

Whether you are a first-time homebuyer, a senior homeowner, or currently living in a condo, co-op, townhouse, or single-family HOA community, professional counseling can help you make informed decisions.

The Waterfront Project, Inc. a HUD Certified Housing Counseling Agency serving Hudson County, New Jersey – we can help you.